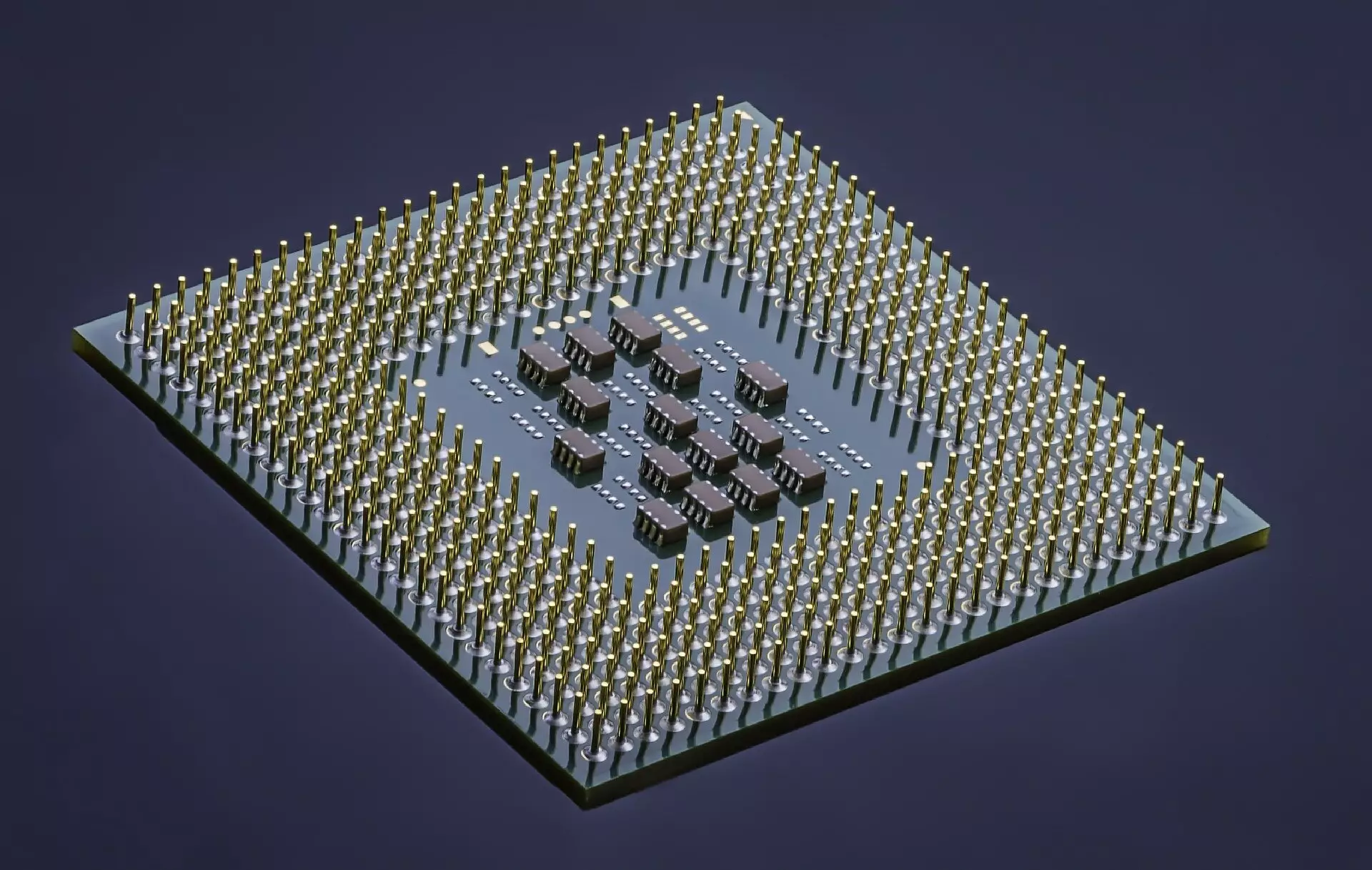

In a strategic move reflecting the escalating significance of semiconductor technology, the UK government recently announced its acquisition of a semiconductor manufacturing plant in Newton Aycliffe, northeast England. This facility, which specializes in the production of gallium arsenide chips, represents a critical asset for the UK, particularly in light of concerns that its potential closure could significantly disrupt the supply chain vital for British defense systems. In an age where technology is deeply interwoven with national security, semiconductors play an indispensable role, primarily as components in military equipment and advanced electronic devices.

UK Defense Secretary John Healey emphasized the necessity of this acquisition by stating, “Semiconductors are at the forefront of the technology we rely upon today, and will be crucial in securing our military’s capabilities for tomorrow.” This remark encapsulates the essence of the UK government’s commitment toward bolstering its defense production capabilities. The move not only aims to secure the technical means intrinsic to military advancement but also serves as a clear indication that the government is willing to invest in and prioritize domestic defense production.

Details surrounding the financial transaction reveal that the British government has purchased the facility from U.S. technology company Coherent Inc. for an estimated £20 million ($27 million). By ensuring the longevity of this manufacturing site, the UK government aims to secure approximately 100 jobs, thus contributing to local employment and economic stability. The acquisition aligns with broader governmental strategies to maintain a robust defense industrial base amidst growing global technological competition.

However, the factory’s future was previously uncertain, particularly following the cessation of a significant contract with Apple, one of its major clients. This highlights an emerging challenge within the semiconductor industry where reliance on a limited number of clients can jeopardize operational viability. As the demand for semiconductors surges, driven by applications in various sectors including smartphones, cars, and advanced defense systems, the UK must navigate these challenges while fostering opportunities for growth and stability within its own semiconductor landscape.

The global landscape for semiconductors is increasingly competitive, with the UK government estimating that the semiconductor market is poised to reach a valuation of $1 trillion by 2030. The strategic ramifications extend beyond national borders, as both the United States and China vie for technological supremacy in this critical field. Semiconductors are essential not just for military enhancement but also for emerging technologies such as artificial intelligence and next-gen wireless networks like 6G.

The UK’s acquisition of the Newton Aycliffe semiconductor facility is a significant step toward fortifying its defense capabilities and securing its position in the global semiconductor market. While the short-term benefits appear favorable, the long-term trajectory will depend on navigational strategies addressing both operational challenges and global competition. The success of this initiative may well dictate the UK’s technological and military readiness in an ever-evolving geopolitical landscape.