The venture capital (VC) landscape in the United States is brimming with anticipation as a slew of unicorns—startups valued at $1 billion or more—are eyeing initial public offerings (IPOs) in 2025. This discussion is prompted by insights from the recent PitchBook/NVCA Venture Monitor report for the fourth quarter of 2024, which attempts to delineate the challenges and opportunities that lie ahead for prospective public companies.

PitchBook has harnessed the power of machine learning to create a VC exit predictor, a sophisticated tool designed to evaluate the probability of a startup‘s successful exit. By analyzing data related to financing rounds, investor activity, and previous company performance, the platform assigns scores to VC-backed companies, reflecting their chances of being acquired, going public, failing, or growing sustainably. Such a robust analytics framework allows stakeholders—investors, founders, and analysts alike—to gauge the potential success of forthcoming public offerings based on current market dynamics and barriers.

Despite signs of recovery in 2024, as reported in the VC landscape, caution remains pervasive. Nizar Tarhuni, Executive Vice President of Research at PitchBook, highlighted that while the landscape saw increased financing and a rise in investment amounts, the emergent trend of early-stage AI-focused transactions at inflated valuations obscures a larger, more complex reality. The persistent disconnect in buyer and seller valuation expectations is a critical issue, cultivated by the inflated financing rounds witnessed in preceding years. Regulatory challenges further hinder the appetite for deals, underscoring the necessity for a recalibrated approach to valuations and funding strategies.

Tarhuni expressed a cautiously optimistic outlook for 2025, suggesting that changes in Washington’s regulatory atmosphere could entice more investments. The anticipated shift in government policies might create a favorable environment for mergers and acquisitions (M&A), fostering an ecosystem where startups can more readily secure capital and then, eventually, go public.

In parallel, Bobby Franklin, CEO of the National Venture Capital Association (NVCA), echoed sentiments of cautious optimism. He pointed out that the transition in leadership within the Federal Trade Commission (FTC) and the Department of Justice (DOJ) could alleviate liquidity challenges faced by portfolio companies. Additionally, potential reforms within the Securities and Exchange Commission (SEC) aimed at reducing the regulatory burden could empower firms to navigate the IPO landscape more effectively. The notion that growing engagement between VCs and policymakers might advance the interests of the venture-backed ecosystem adds another layer of complexity to the landscape.

A tax bill progressing through Congress holds potential ramifications for innovation and industry vitality, with implications for the restoration of the R&D tax credit. Such developments could further encourage investment in research and development, directly benefitting the tech unicorns poised to enter the market.

Among these unicorns, specific companies stand out based on their projected IPO probability. For instance, Anduril, an aerospace and defense company founded by Oculus architect Palmer Luckey, boasts an impressive 97% chance of going public in 2025. Similarly, the Web3 gaming firm Mythical Games shows the same likelihood underlining the intersection of innovative tech and business strategy in the modern market. A number of other companies, including Ayar Labs, Carbon, and Databricks, also exhibit high probabilities of entering the public market.

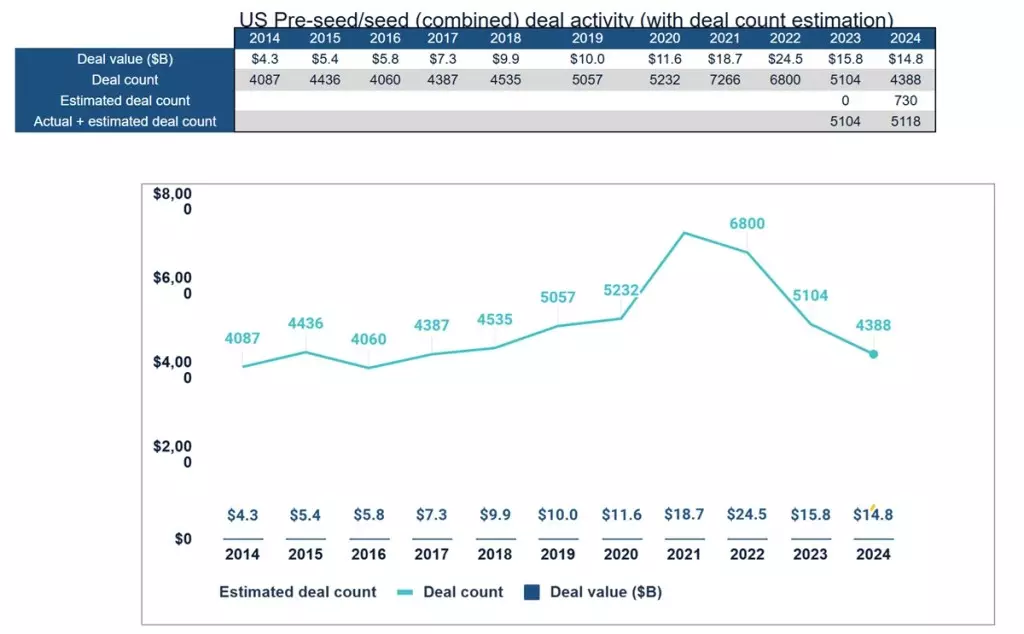

Yet, the broader data reveals an interesting trend: in 2024, startups that raised between $1 million to $5 million represented the largest category—signaling an enigmatic contraction from previous peaks. This decline from 5,310 in 2021 to 3,153 in 2024 raises questions about venture capital dynamics and highlights growing frugality among investors.

While there remains palpable optimism for IPOs in 2025, stakeholders must navigate a multifaceted environment shaped by regulatory reform, evolving investor sentiment, and market conditions. The future of U.S. unicorns hinges not just on their technological innovations but also on their ability to align with emerging financial realities and adapt to a continuously shifting landscape. As the clock winds down toward 2025, the anticipation intensifies—not just for the unicorns themselves but for the investors and broader economy awaiting their contributions to growth and innovation.