In the fast-evolving realm of retail technology, few concepts have sparked as much interest as cashierless checkout systems. Grabango, a startup that emerged in 2016, positioned itself as a formidable competitor against retail giant Amazon. However, recent announcements have confirmed the company’s shutdown due to a lack of sufficient funding. This development not only highlights challenges within the venture capital ecosystem but also raises questions about the future of cashierless technology in a market increasingly dominated by major players.

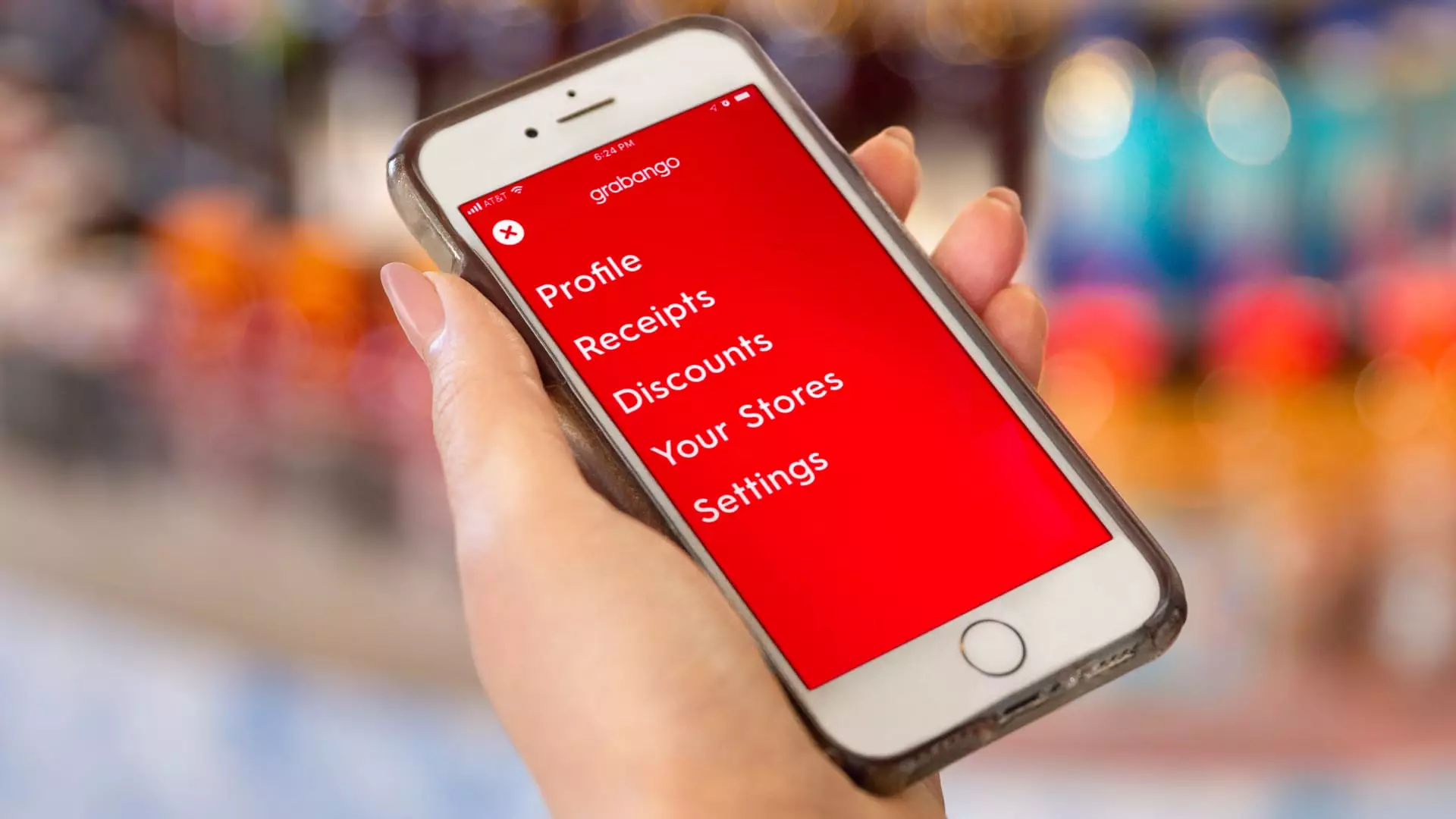

Founded by Will Glaser, a notable figure in tech circles with prior experience co-founding Pandora, Grabango sought to revolutionize shopping experiences by employing computer vision and machine learning to facilitate a seamless checkout process. The technology enabled consumers to bypass traditional cashiers by simply taking items off store shelves, thereby streamlining the retail experience. The company attracted attention from various grocery and convenience store chains, including Aldi and 7-Eleven, and enjoyed notable funding rounds that totaled over $73 million.

Despite its innovative approach and early promise, Grabango’s journey hit a roadblock when it failed to secure additional financing necessary for its operations. CNBC highlighted a statement from a company spokesperson who expressed gratitude to all stakeholders involved, pointing out the conflicting realities of technological advancement and financial sustainability. Although Grabango had successfully positioned itself as a leader in its niche, the waning interest in IPOs and the drying up of venture capital following the market downturn have created insurmountable barriers for many startups.

The broader venture capital landscape has shifted significantly since 2022, with a notable decline in liquidity that has particularly affected early-stage tech companies outside of a few dominant sectors such as artificial intelligence. In a climate where funding opportunities are limited, even companies with substantial prior investments can find themselves in precarious positions. Grabango’s financial struggles encapsulate this reality, demonstrating that innovation alone does not guarantee success; financial backing is equally crucial.

Grabango’s closure provides a lens through which to examine the competitive dynamics in the cashierless technology market. Amazon, with its Just Walk Out service, has long been a formidable player, aggressively deploying its technology in a variety of environments, from convenience stores to airports. The significant scale of Amazon allows for greater resilience against market fluctuations and operational setbacks, especially in a climate where securing consistent funding has become increasingly challenging for smaller firms.

Moreover, Grabango’s decision to forgo shelf sensor technology in favor of an advanced computer vision system raised eyebrows and spurred discussions about effectiveness in a competitive landscape. Glaser’s assertion that traditional technologies can become liabilities speaks to the need for continuous innovation. However, as Amazon demonstrated, having an early foothold can afford a company the luxury of iterate and improve upon its offerings, complicating the prospects for new entrants like Grabango.

With Grabango’s exit from the market, a crucial question emerges: what does this mean for the future of cashierless technologies? While the immediate implications seem negative, such shutdowns often pave the way for consolidation and refinement within a sector. Existing companies can learn from Grabango’s experience, addressing its challenges to enhance their offerings and market positioning.

The cashierless checkout landscape still has room for growth, especially as consumer behaviors are shifting towards convenience and efficiency. Other startups like AiFi and Trigo now find themselves in a more complex ecosystem, wherein they not only have to contend with Amazon but also learn from the missteps of their predecessors. The potential for widespread adoption of innovative technologies remains high, but the financial and operational realities these companies face cannot be ignored.

While the collapse of Grabango is a setback for the retail technology space, it also serves as a reminder of the necessity for robust financial strategies alongside technological advancements. The path to success in such a competitive environment will require adaptability, foresight, and perhaps, a greater emphasis on sustainable business practices to weather the inevitable storms of industry flux.